Best Share Market Company in India: A Structured Evaluation for Serious Investors

Selecting the best share market company requires more than reviewing marketing claims.

It demands an understanding of how the company operates, manages risk, and delivers consistent decision-making.

Equity markets reward discipline over time. Therefore, investors must assess share market companies using objective, verifiable criteria. This guide explains those criteria in detail, with a focus on long-term reliability rather than short-term performance narratives.

What Is the Role of a Share Market Company?

A share market company provides professional support for individuals and institutions participating in equity markets.

Its role varies depending on service scope, but responsibility always remains high.

Core Functional Responsibilities

A professionally managed company typically delivers:

- Structured equity research and stock evaluation

- Advisory or portfolio management services

- Risk assessment and capital deployment frameworks

- Performance monitoring and reporting

- Ongoing market communication and education

The best share market company defines these responsibilities clearly and avoids overlapping roles that create conflicts of interest.

Why Identifying the Best Share Market Company Requires Careful Analysis

The equity market operates under uncertainty.

Therefore, labels such as “best” require context.

A company optimized for short-term trading may not be suitable for long-term wealth creation. Similarly, aggressive strategies can expose conservative investors to unnecessary volatility. The selection process must align company capabilities with investor objectives.

Key Parameters That Define the Best Share Market Company

Every best share market company is built on structured systems rather than discretionary decision-making.

Regulatory Compliance and Governance

Compliance establishes legitimacy.

In India, a professional share market company must:

- Maintain valid SEBI registration

- Operate within defined advisory or PMS guidelines

- Disclose scope, limitations, and responsibilities

- Follow audit and reporting norms

Regulatory clarity protects both capital and investor rights

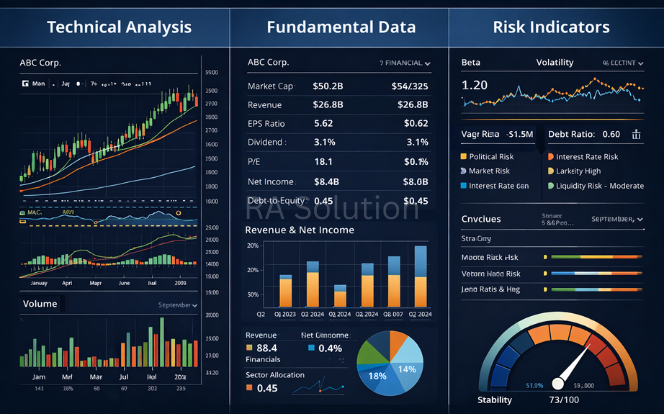

Research Methodology and Investment Framework

Research quality directly influences outcomes.

A reliable company follows a documented framework that includes:

- Fundamental analysis of financial statements and ratios

- Technical evaluation of price trends, volume, and volatility

- Sector-based allocation analysis

- Macro-economic impact assessment

The best share market company communicates this methodology transparently instead of relying on outcome-based marketing.

Risk Management Architecture

Risk management determines sustainability.

Professional companies implement:

- Defined position-sizing rules

- Pre-determined exit strategies

- Portfolio-level risk limits

- Drawdown control mechanisms

A best share market company treats risk management as a core process, not a corrective measure.

Technology Infrastructure Used by Share Market Companies

Technology improves consistency and oversight.

Market Data and Performance Analytics

Advanced firms rely on:

- Real-time and historical market data

- Trade performance attribution tools

- Portfolio analytics dashboards

- Volatility and correlation monitoring systems

These systems allow the best share market company to evaluate decisions objectively.

Algorithmic and Rule-Based Execution

Rule-based systems support discipline.

They enable:

- Strategy-driven trade execution

- Reduced emotional intervention

- Faster response to market conditions

- Consistent application of predefined rules

Technology supports judgment but does not replace accountability.

Advisory Services vs Portfolio Management Services

Understanding service structure avoids misalignment.

Share Market Advisory Services

Advisory models involve:

- Trade or investment recommendations

- Strategy guidance based on research

- Independent execution by the investor

This structure suits investors who prefer control and market involvement.

Portfolio Management Services (PMS)

PMS includes:

- Discretionary fund management

- Asset allocation decisions

- Periodic portfolio review

The best share market company explains service boundaries clearly before onboarding clients.

Transparency as an Operational Standard

Transparency reflects operational maturity.

Performance Reporting Practices

Ethical companies disclose:

- Strategy-wise returns

- Periods of underperformance

- Market-driven volatility impact

The best share market company provides context, not selective data.

Fee and Cost Disclosure

Professional firms communicate:

- Fixed and variable fee components

- Performance-linked conditions

- Exit and modification policies

Clear disclosure reduces future disputes.

Client Communication and Support Systems

Communication quality indicates reliability.

Structured Reporting and Updates

Reliable firms maintain:

- Regular portfolio updates

- Trade rationale documentation

- Market outlook briefings

Consistency builds confidence during uncertain phases.

Investor Education Initiatives

Education strengthens decision-making.

The best share market company invests in:

- Market fundamentals training

- Risk-awareness sessions

- Strategy explanation sessions

Informed investors remain disciplined.

Warning Signs Investors Should Not Ignore

Avoidable mistakes lead to capital erosion.

Guaranteed Return Commitments

Equity markets do not offer certainty.

Such claims indicate misrepresentation.

Tip-Oriented Selling

Sustainable outcomes result from systems, not isolated calls.

Lack of Verifiable Track Record

Experience must be supported by documented processes and performance explanations.

How the Best Share Market Company Builds Long-Term Value

Wealth creation requires consistency.

Process-Led Decision Making

Professional firms emphasize:

- Capital preservation

- Gradual compounding

- Market-cycle alignment

Speculative behavior increases volatility.

Continuous Strategy Review

Markets evolve continuously.

The best share market company:

- Reviews historical performance

- Adjusts parameters

- Integrates new data insights

Adaptability sustains relevance.

Ethical Standards and Responsibility

Ethics determine long-term survival.

Conflict-Free Advisory Models

Ethical companies avoid:

- Commission-driven bias

- Excessive trading incentives

- Broker-aligned recommendations

Client interest remains primary.

Data Security and Confidentiality

Responsible firms ensure:

- Secure digital infrastructure

- Controlled access systems

- Regulatory compliance

Trust depends on data protection.

Importance of Experience in Share Market Services

Experience complements technology.

Exposure to Market Cycles

Experienced professionals have navigated:

- Bull expansions

- Bear corrections

- High-volatility events

This exposure improves judgment.

Understanding Investor Psychology

Behavior influences outcomes.

The best share market company accounts for:

- Emotional decision patterns

- Market sentiment shifts

- Behavioral risk factors

Managing psychology protects capital.

How to Shortlist the Best Share Market Company

Structured evaluation improves selection.

Due-Diligence Questions

- Is the company SEBI registered?

- How is risk quantified and controlled?

- What systems support decisions?

- How transparent is reporting?

Clear responses reflect professionalism.

conclusion

The best share market company is defined by discipline, not declarations.

It prioritizes systems, transparency, and accountability.

Equity investing is a long-term commitment.

Choose a company that respects process, capital, and investor trust.